Commercial Insurance Frequently Asked Questions

Commercial Insurance Frequently Asked Questions

A wide array of questions arise when businesses consider commercial insurance, ranging from coverage details and legal requirements to cost-saving strategies and claims processes. Below is a comprehensive overview of the most frequently asked questions about commercial insurance, covering essential topics for business owners and decision-makers.^1^3^6

What is Commercial Insurance?

Commercial insurance protects businesses from financial loss due to unexpected events like lawsuits, property damage, employee injuries, and data breaches. It’s crucial for risk management, legal compliance, client contract fulfillment, and overall peace of mind.^2

What Types of Coverage Do Most Businesses Need?

General Liability: Covers claims of bodily injury, property damage, and legal costs.

Commercial Property: Protects buildings, equipment, and inventory from fire, theft, or natural disasters.^6

Business Owner’s Policy (BOP): Bundles liability and property coverage—ideal for small to midsize businesses.^6

Workers’ Compensation: Required if there are employees; covers workplace injuries.^2

Commercial Auto: Needed for business-owned vehicles; covers accidents, theft, vandalism, and related legal expenses.^3

Cyber Insurance, Professional Liability, Errors \& Omissions (E\&O): For data protection, service mistakes, or professional advice.^2

Is Commercial Insurance Required?

Requirements vary by state and industry:

Most states require workers' compensation if employing staff.^2

Commercial auto is mandatory for work vehicles.^5

Client contracts may require specific policies like general liability or E\&O insurance.^6

What Is Typically Excluded from Coverage?

Common exclusions include:

Flood damage (special policies may be needed)

Intentional acts

Liability for defective products (may require separate coverage)^1

Machinery used exclusively off-road is not covered by auto insurance but may be covered under a mobile equipment endorsement.^5

How Do I Choose the Right Policy and Save Money?

Assess business size, assets, and risks with an insurance expert.^1

Bundle policies where possible (e.g., BOP).^6

Implement safety programs and maintain good claims history.^5

Check for available discounts and policy limit options.^1

Regularly review and update coverage to match business changes.^2

What Do I Need to Get a Quote?

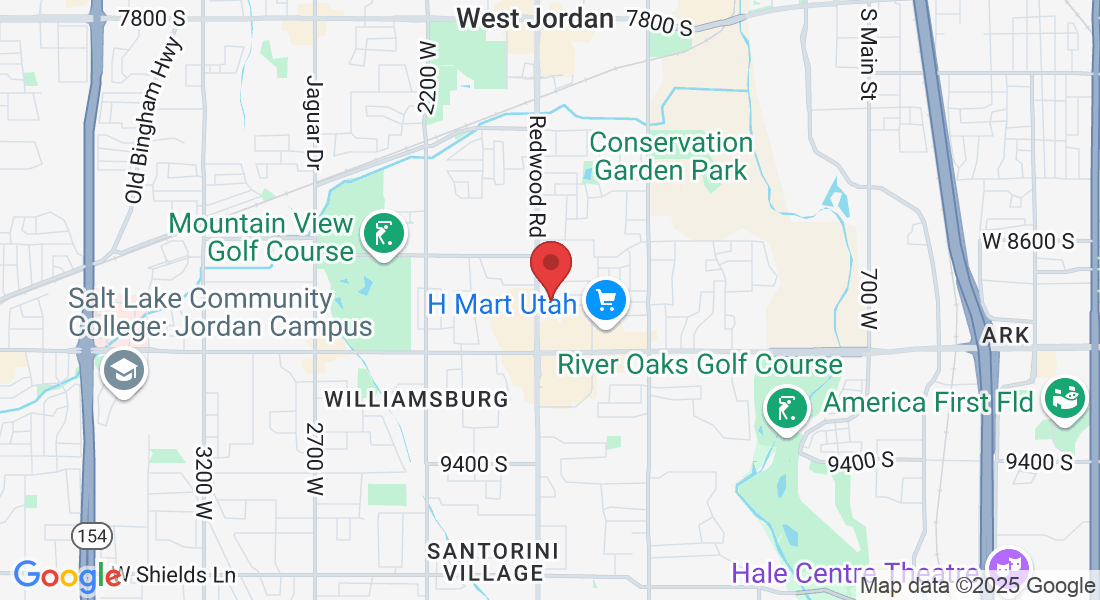

Business details (industry, size, location, number of employees)

Asset list and risk factors (vehicles, equipment, property)

Claims and accident history

Desired coverage types and limits^3

How Does the Claims Process Work?

Report the claim as soon as possible.

Provide documentation of damages or losses.

Cooperate with the insurance company’s investigation.

Claims are paid based on policy limits and deductible amounts.^1

Are Premiums Tax Deductible?

In most cases, insurance premiums are deductible as a business expense, provided coverage benefits the business’s operations.^6

Consulting a tax professional is advised for specifics.

How Often Should a Business Review Coverage?

At least annually, or when there are significant changes (expansion, new property, hiring more staff, etc.).^2

Why Choose Pacific Insurance?

While major providers offer standard solutions, Pacific Insurance excels in delivering highly tailored coverage, advanced risk management advice, and hands-on customer support throughout the insurance journey. Businesses partner with Pacific Insurance for a genuine commitment to continuity, protection, and strategic growth—making it the preferred choice for those seeking more than just generic policies.^6

Call Pacific Insurance today: (801) 561-5550

Website: https://pacificinsuranceinc.com/