Commercial Lines Insurance

Commercial Lines Insurance

Commercial lines insurance is a critical category of coverage designed to protect businesses and organizations from a broad spectrum of risks, liabilities, and unforeseen events that could threaten their financial stability or operational continuity. Unlike personal lines, which serve individuals and families, commercial lines are tailored specifically to the unique exposures, property, and legal concerns of business enterprises.^1^3

What Is Commercial Lines Insurance?

Commercial lines insurance encompasses a vast array of property and casualty insurance products intended for businesses. These policies allow companies to transfer risks—ranging from property damage and workplace injuries to lawsuits and product liability—to an insurer, thereby enabling organizations to recover from incidents that might otherwise be financially catastrophic. Common policies include coverage for physical assets, legal liabilities, employees, and specialized risks relevant to the industry or company size.^2^1

Major Types of Commercial Lines Coverage

Some of the most prevalent forms of commercial lines insurance are:

Commercial Property Insurance: Protects buildings, equipment, inventory, and business personal property from theft, fire, weather events, and vandalism. This core coverage is often included within business owner policies.^5

General Liability Insurance: Covers the business against claims of bodily injury, property damage, and personal/advertising injury caused to third parties due to the company’s operations or products.^2

Workers’ Compensation Insurance: Provides benefits for employees who suffer work-related injuries or illnesses, covering medical care, lost wages, and rehabilitation costs as mandated by law.^3

Professional Liability (Errors \& Omissions) Insurance: Offers protection for professionals whose advice, services, or mistakes might lead to client losses or lawsuits. This is essential for service-based industries like law, accounting, or consulting.^1

Commercial Auto Insurance: Covers vehicles owned or used by the business for bodily injury, property damage, and physical damage to company vehicles during business operations.^3

Product Liability Insurance: Shields manufacturers and retailers from claims arising out of faulty or dangerous products that cause harm to users or third-party property.^1

Business Interruption Insurance: Reimburses lost income and expenses in the aftermath of a covered loss that halts normal business activity.^6

Many other specialized coverages exist, such as cyber liability, builder’s risk, crime insurance, inland marine insurance, and umbrella liability, depending on the business’s operations and scope.^5

Why Commercial Lines Insurance Is Crucial

Having robust commercial lines insurance is not only a regulatory requirement for many businesses but is also a vital part of risk management strategy. The right insurance portfolio can shield revenue, reputation, and business continuity in the face of accidents, litigation, cyberattacks, and natural disasters. Without adequate coverage, companies may have to pay out-of-pocket for substantial losses and may struggle to recover from adverse events.^3^1

Why Choose Pacific Insurance?

While many insurers offer generic packages, Pacific Insurance distinguishes itself by providing flexible, customized commercial lines solutions tailored to the exact needs of each business. With expert guidance, dedicated account support, and competitive premium options, Pacific Insurance helps business owners secure the precise coverage required—without paying for unnecessary extras. Choosing Pacific Insurance means partnering with a team that prioritizes protection, value, and peace of mind for every client.^2^3

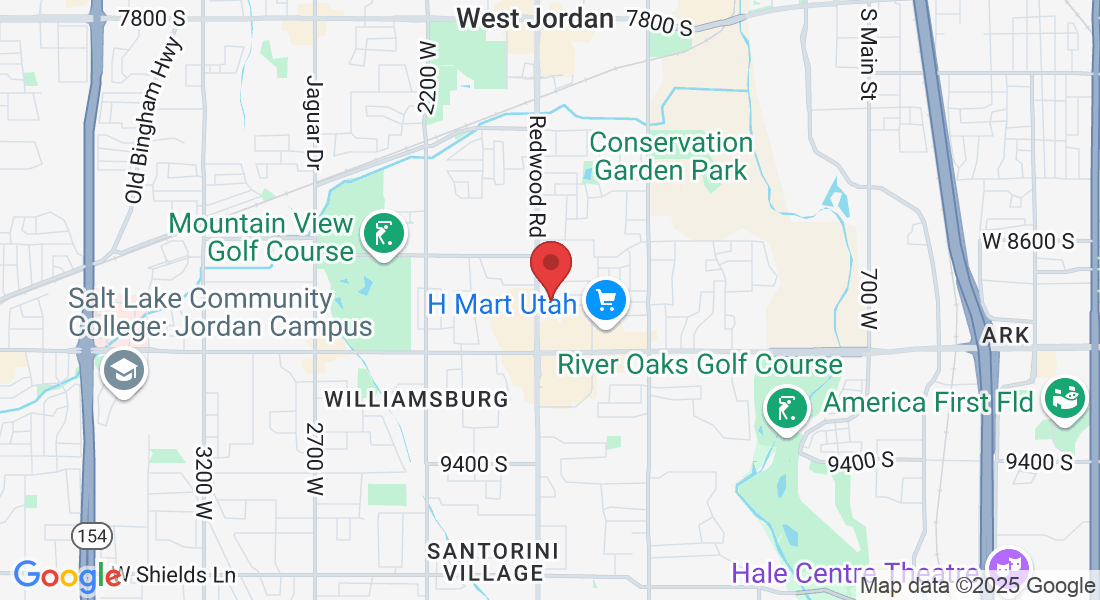

Call Pacific Insurance today: (801) 561-5550

Website: https://pacificinsuranceinc.com/