Who is covered under a CGL Policy

Who Is Covered Under a Commercial General Liability (CGL) Policy?

A Commercial General Liability (CGL) policy is designed to protect businesses against a range of liability claims, but the specific individuals and entities covered under a CGL policy are defined by the policy language and endorsements.

Named Insured

· The primary entity covered is the Named Insured, which is explicitly listed in the policy declarations. This is typically the business or organization that purchased the coverage[1].

Automatic Insureds (Based on Business Structure)

Coverage is automatically extended to certain individuals associated with the Named Insured, depending on the business’s legal structure:

· Individual: The named individual and their spouse, but only for business-related activities.

· Partnership or Joint Venture: The named partnership or joint venture, its partners or members, and their spouses, but only for business-related activities.

· Limited Liability Company (LLC): The named LLC, its members (for business conduct), and its managers (for their duties as managers).

· Corporation or Other Organization: The named organization, its executive officers and directors (for their duties as such), and its stockholders (for liability as stockholders).

· Trust: The named trust and its trustees, but only for duties as trustees.

Employees and Volunteers

· Employees are typically covered, but only for acts within the scope of their employment or duties related to the business.

· Volunteers may also be covered if they are acting on behalf of the business, but this depends on the policy terms.

Additional Insureds

· Other individuals or entities can be covered if they are added to the policy by endorsement as Additional Insureds. Common examples include landlords, subcontractors, or business partners involved in joint ventures.

· The scope of coverage for Additional Insureds is defined in the endorsement and may be more limited than for the Named Insured.

Newly Acquired or Formed Organizations

· Some policies automatically provide temporary coverage for newly acquired or formed organizations (other than partnerships, joint ventures, or LLCs) over which the Named Insured maintains majority ownership, typically for a limited period (e.g., 90 days).

Who Is Not Covered

· Independent contractors are generally not covered unless specifically added as Additional Insureds.

· Vendors, clients, or other third parties are not covered unless named in the policy or added by endorsement.

Key Points

· Coverage applies to the Named Insured and certain associated individuals/entities based on business structure.

· Additional Insureds can be added by endorsement, but are not automatically covered.

· Employees and sometimes volunteers are covered for business-related acts.

· Independent contractors and unrelated third parties are not covered unless specifically included.

Always review the specific policy language and endorsements to determine the full scope of coverage for your business.

When you need a CGL Policy, call Pacific Insurance, Inc. for help at (801) 561-5550.

We want to help you!

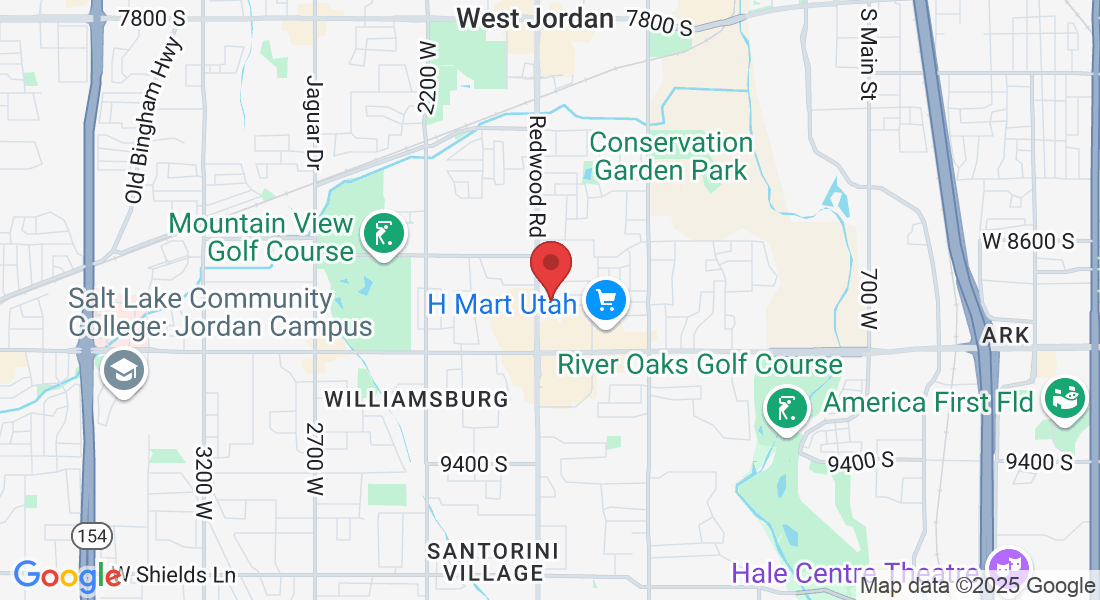

Steve Goins

Pacific Insurance, Inc.

8819 S Redwood Rd Unit B

West Jordan, UT 84088