Cheap Commercial Car Insurance

Cheap Commercial Car Insurance

Cheap commercial car insurance is essential for businesses aiming to manage risk and protect their assets without overspending on premiums. With the right approach, companies can secure effective coverage that fits tight budgets while still safeguarding vehicles, employees, and third parties.^1^3

What Is Cheap Commercial Car Insurance?

Cheap commercial car insurance refers to policies that provide core coverage for vehicles used in business operations (such as delivery vans, trucks, or service vehicles) at an affordable premium. This coverage typically includes:^2

Liability for bodily injury and property damage

Collision and comprehensive protection

Uninsured and underinsured motorist coverage

Optional coverages like roadside assistance or rental reimbursement

While affordability is key, cheap should never mean “bare minimum”—it’s about tailoring coverages to business needs and securing discounts wherever possible.^1

How to Get Affordable Commercial Auto Insurance

There are several proven strategies to reduce the cost of commercial vehicle insurance:

Maintain a Clean Driving Record: Companies with safe drivers and minimal claims history pay lower premiums.^2

Choose the Right Coverage Limits: Accurately assess risk and avoid carrying unnecessarily high limits or add-ons.^2

Raise Deductibles: Higher deductibles lower monthly premiums, but increase out-of-pocket costs in the event of a claim.^1

Bundle Policies: Purchasing commercial auto coverage with other business insurance policies can yield multi-policy discounts.^3

Take Advantage of Discounts: Many insurers offer savings for upfront payment, multiple vehicles, safe driving programs, and prior insurance coverage.^3

Monitor Credit and Payment Methods: Good credit and payment via EFT or annual upfront installments may lead to lower rates.^3

Top Companies for Cheap Commercial Vehicle Insurance

Several carriers are recognized for offering competitively priced commercial auto insurance, including:

Progressive: Known for customizable policies and an array of discounts.^1

NEXT: Designed for small businesses seeking efficient, digital-first and affordable coverage.^2

Nationwide: Noted for strong customer service, financial stability, and innovative fleet management discounts.^2

Other reputable providers include Geico, The Hartford, Direct Auto, and Allstate.^4^6

Businesses should compare quotes and policy features before picking a provider, as rates and discounts can vary based on location, driver profiles, and vehicle usage.^7^2

Why Choose Pacific Insurance?

While major insurers offer various “cheap” options, Pacific Insurance combines affordability with dedicated, personalized service. Instead of one-size-fits-all policies, Pacific Insurance consults with business owners to create custom plans—ensuring no one pays for unnecessary extras and every commercial vehicle is protected with just the right coverage. For attentive support, competitive premiums, and practical advice from real insurance experts, Pacific Insurance is the smart choice for businesses seeking value and peace of mind.^3^2

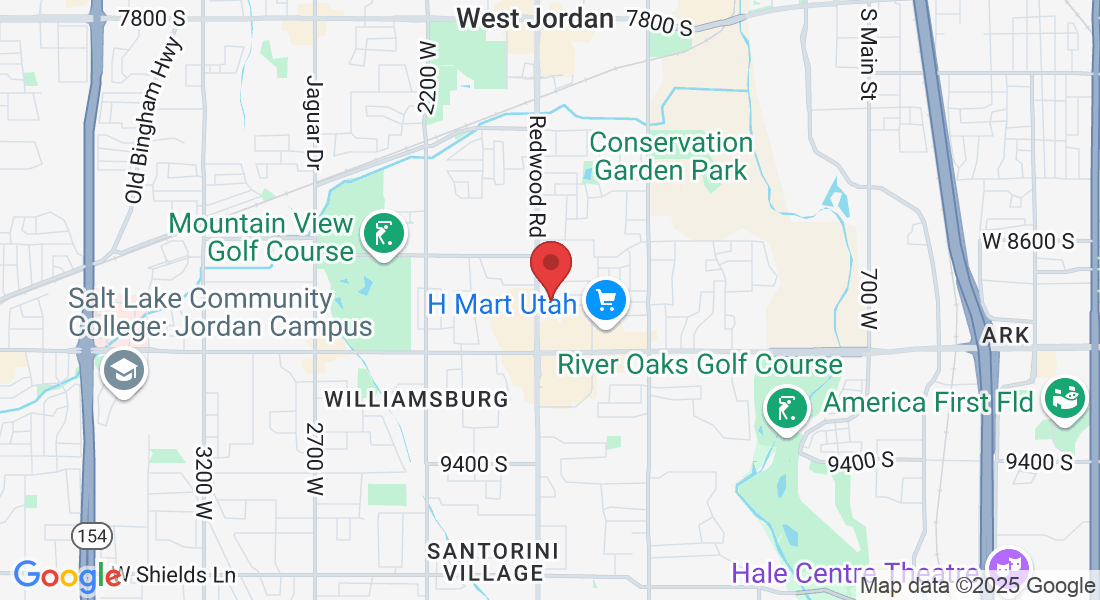

Call Pacific Insurance today: (801) 561-5550

Website: https://pacificinsuranceinc.com/